How Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.

How Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.

Blog Article

10 Easy Facts About Matthew J. Previte Cpa Pc Explained

Table of ContentsGetting The Matthew J. Previte Cpa Pc To WorkThe 6-Minute Rule for Matthew J. Previte Cpa PcHow Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.Matthew J. Previte Cpa Pc - The FactsGet This Report about Matthew J. Previte Cpa PcWhat Does Matthew J. Previte Cpa Pc Do?

Tax regulations and codes, whether at the state or federal degree, are as well made complex for a lot of laypeople and they transform as well usually for several tax professionals to keep up with. Whether you simply require someone to help you with your company revenue tax obligations or you have been charged with tax fraud, work with a tax obligation attorney to help you out.

Some Of Matthew J. Previte Cpa Pc

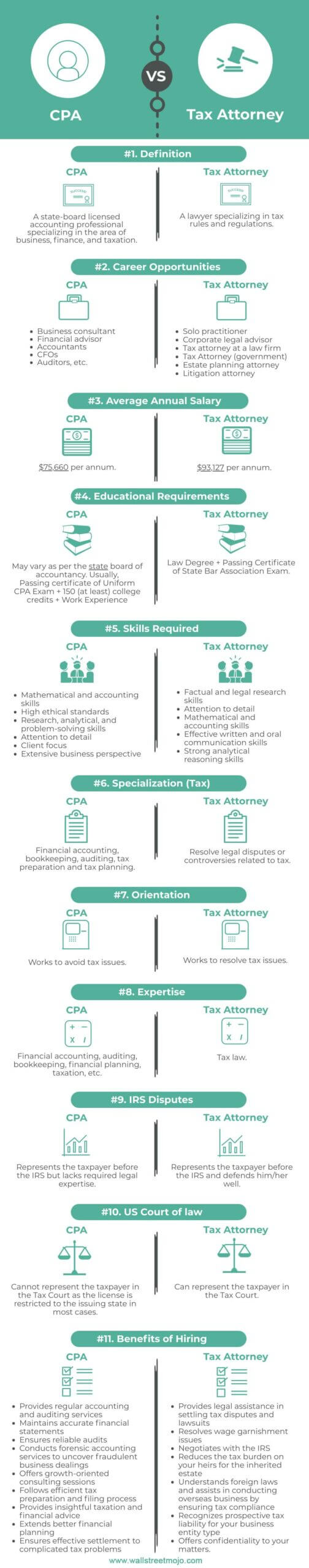

Every person else not only dislikes dealing with tax obligations, but they can be outright worried of the tax obligation companies, not without reason. There are a few concerns that are always on the minds of those that are dealing with tax troubles, consisting of whether to hire a tax lawyer or a CERTIFIED PUBLIC ACCOUNTANT, when to work with a tax obligation lawyer, and We wish to assist respond to those questions here, so you know what to do if you discover on your own in a "taxing" scenario.

A lawyer can represent clients prior to the IRS for audits, collections and allures but so can a CERTIFIED PUBLIC ACCOUNTANT. The huge difference right here and one you need to keep in mind is that a tax obligation lawyer can provide attorney-client opportunity, meaning your tax obligation legal representative is exempt from being obliged to testify against you in a court of regulation.

An Unbiased View of Matthew J. Previte Cpa Pc

Or else, a certified public accountant can testify against you also while benefiting you. Tax obligation attorneys are extra acquainted with the various tax settlement programs than a lot of CPAs and recognize how to choose the ideal program for your situation and exactly how to get you gotten that program. If you are having a trouble with the IRS or simply concerns and problems, you require to hire a tax lawyer.

Tax obligation Court Are under examination for tax obligation fraud or tax obligation evasion Are under criminal examination by the IRS An additional important time to work with a tax lawyer is when you receive an audit notification from the IRS - Due Process Hearings in Framingham, Massachusetts. http://prsync.com/matthew-j-previte/. A lawyer can connect with the IRS in your place, exist throughout audits, help negotiate settlements, and keep you from overpaying as an outcome of the audit

Component of a tax obligation attorney's task is to stay on par with it, so you are shielded. Your finest resource is word of mouth. Ask about for a seasoned tax obligation lawyer and inspect the internet for client/customer evaluations. When you interview your option, request for additional references, especially from clients that had the very same issue as your own.

The Only Guide to Matthew J. Previte Cpa Pc

The tax attorney you have in mind has all of the best qualifications and reviews. All of your inquiries have been responded to. Unfiled Tax Returns in Framingham, Massachusetts. Should you employ this tax obligation attorney? If you can manage the costs, can accept the type of prospective remedy provided, and have self-confidence in the tax obligation attorney's capacity to assist you, then of course.

The choice to hire an internal revenue service lawyer is one that need to not be ignored. Attorneys can be incredibly cost-prohibitive and make complex issues unnecessarily when they can be fixed fairly easily. In general, I am a large advocate of self-help lawful solutions, especially offered the variety of educational material that can be found online (consisting of much of what I have released on taxes).

The 45-Second Trick For Matthew J. Previte Cpa Pc

Below is a quick list of the issues that I think that an IRS lawyer must be worked with for. Bad guy fees and criminal investigations can ruin lives and bring extremely pop over to this site serious repercussions.

Bad guy fees can likewise bring extra civil charges (well past what is common for civil tax issues). These are simply some examples of the damages that also just a criminal charge can bring (whether or not a successful sentence is eventually obtained). My point is that when anything potentially criminal occurs, also if you are just a potential witness to the issue, you require a seasoned IRS lawyer to represent your passions versus the prosecuting firm.

Some might cut short of absolutely nothing to obtain a conviction. This is one instance where you constantly need an IRS attorney enjoying your back. There are lots of parts of an internal revenue service lawyer's work that are relatively regular. A lot of collection matters are handled in about similarly (although each taxpayer's situations and goals are various).

Matthew J. Previte Cpa Pc Can Be Fun For Everyone

Where we gain our red stripes however is on technical tax obligation issues, which placed our complete ability set to the test. What is a technological tax problem? That is a tough inquiry to respond to, yet the very best way I would certainly explain it are issues that call for the specialist judgment of an internal revenue service lawyer to solve effectively.

Anything that possesses this "truth dependency" as I would call it, you are mosting likely to intend to generate a lawyer to consult with - tax attorney in Framingham, Massachusetts. Also if you do not retain the solutions of that lawyer, an expert point of view when handling technological tax matters can go a long way towards recognizing issues and resolving them in a proper manner

Report this page